- ZA's Pulse: Where Purpose, Strategy, and Impact Converge

- Posts

- Special Edition

Special Edition

Special Edition: We Built Something for You

Your new financial planning app is here - and it’s different from everything else

🌟 Hey Zillennial Fam

Let's be real—you were probably expecting our usual quarterly breakdown. The Fed's rate cuts, stock market volatility, tech sector chaos—all the stuff we normally dissect for you.

But here's the thing: we've spent the last year building something that matters more than any market analysis we could write.

We get it—you're drowning in financial apps. Your banking app shows balances. Credit Karma shows your score. Robinhood handles investing. Mint tracked spending (RIP). And after checking all five apps? You still don't know what to actually DO with your money.

So instead of telling you what happened in the markets this quarter, we're giving you the tools to take action on your finances regardless of what the market does.

Market Pulse will be back next quarter—stronger than ever. But today? Today we're introducing Parity.

Overview

🔎 What to Expect?

Instead of our usual policy and economic deep dives, this special edition covers the launch of Parity—the app we've been building based on YOUR feedback. We'll break down the problem we're solving, the solution we built, and the exclusive deal for newsletter subscribers.

🕒 Read Time: 5 minutes

Shorter than Market Pulse—because we want you spending time IN the app, not reading about it.

The Product Launch

Why We Built This

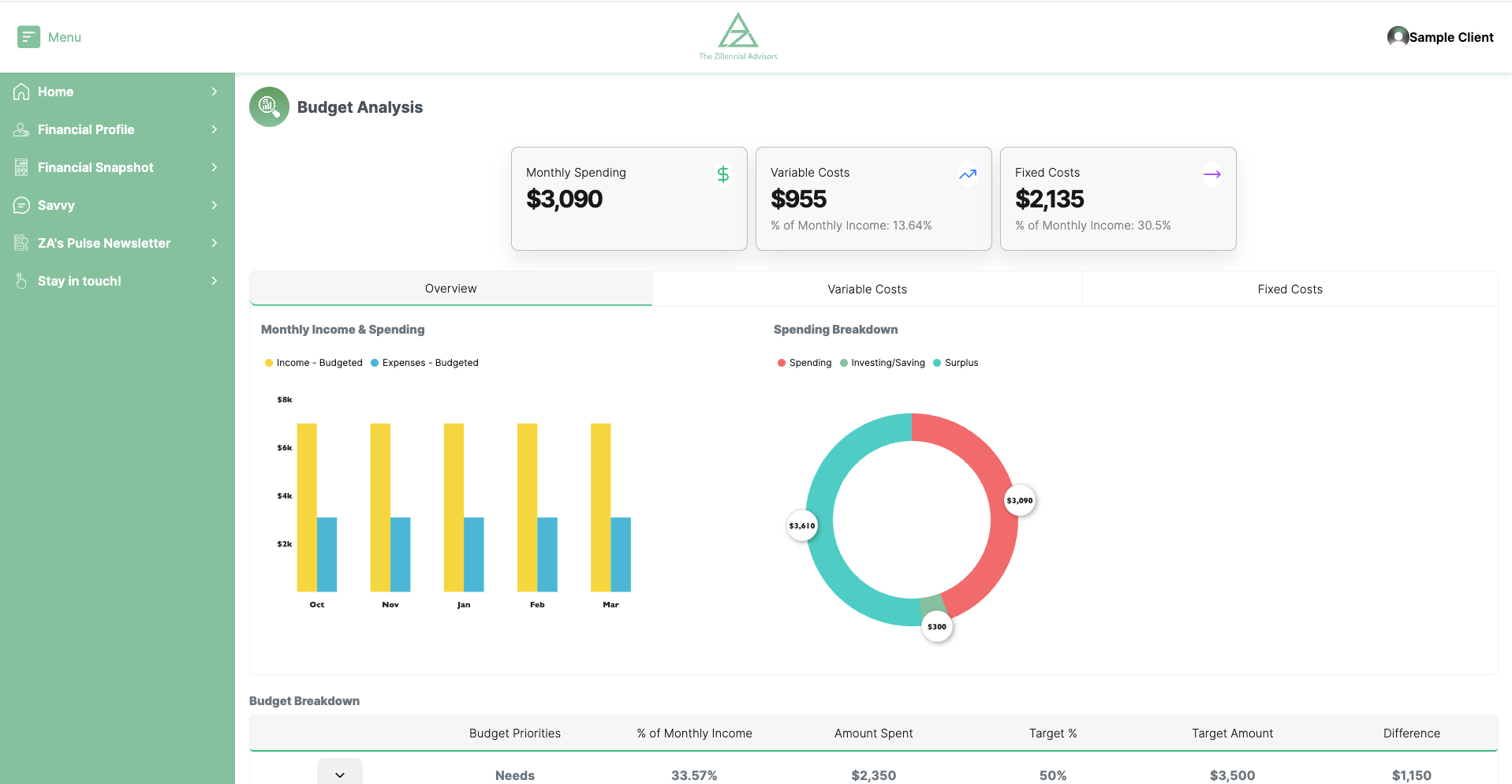

Parity is more than a tracking app — it offers automated financial-planning tools that help generate a personalized monthly action plan based on the information you provide

The Tracking Trap: The financial app industry has spent a decade perfecting how to show you your money, but nobody solved what actually matters—telling you what to do about it. You can see every transaction, but you're still paralyzed deciding between paying off debt, building emergency funds, or investing.

The Advice Gap: Financial advisors serve people with $100,000+ invested; robo-advisors need $10,000 minimums; budgeting apps lecture you about coffee. There's literally nothing built for people in the messy middle—dealing with student loans, irregular income, and trying to figure out if they can actually afford a house someday.

The Complexity Crisis: Personal finance has become a part-time job. Compare credit cards. Research brokerages. Calculate debt payoff strategies. Build spreadsheets. Update multiple apps. Most people give up before they start because the cognitive load is overwhelming.

Pain Points Parity Will Help Solve

Finally, see checking, savings, investments, and debt in one place with a real-time net worth that updates automatically—no more spreadsheet reconciliation at month-end.

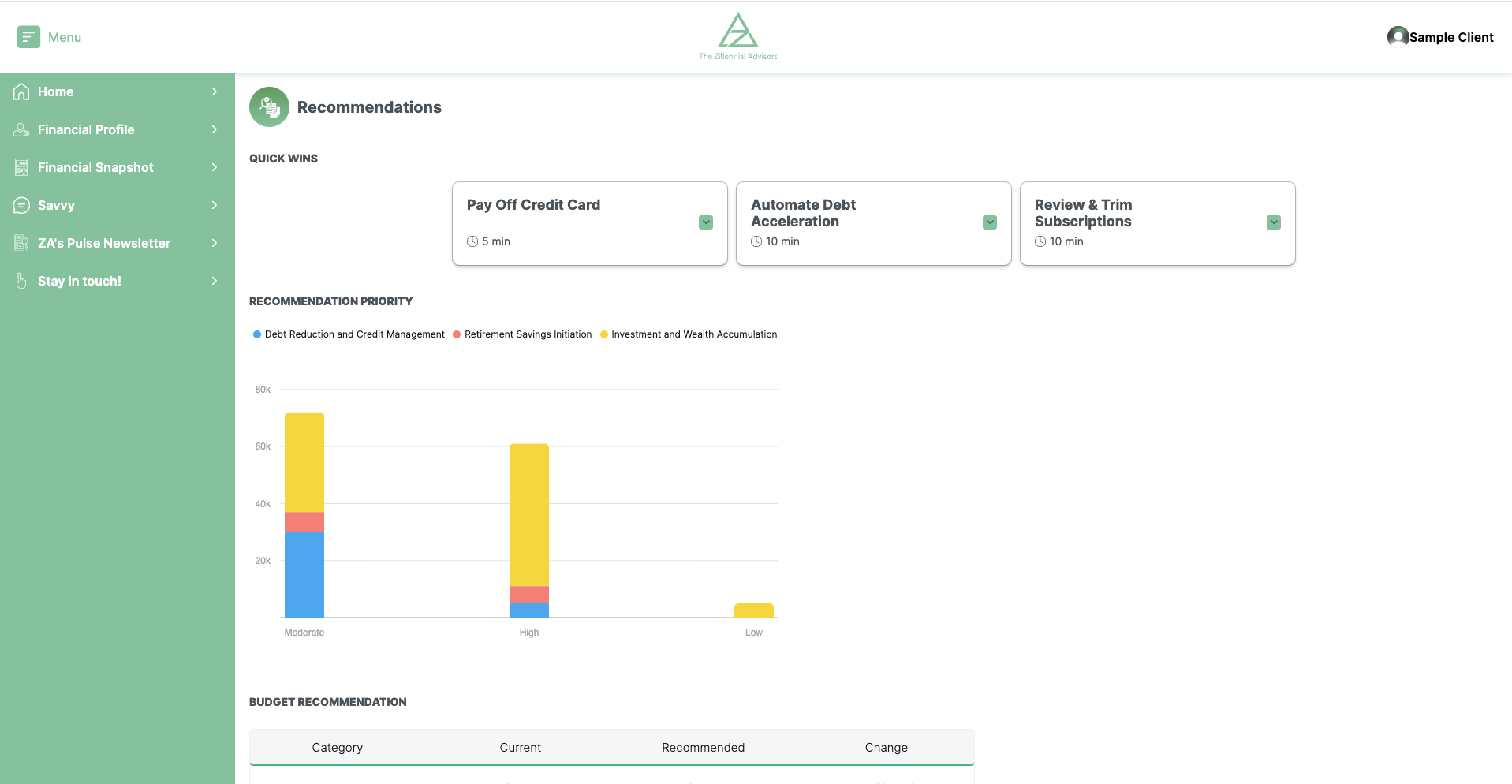

Decision Fatigue Ends: You'll stop spending hours researching what to do with your money—Parity analyzes your financial picture and recommends next steps prioritized by likely impact. Recommendations are based on the information you provide and on automated models.

Action Over Anxiety: Instead of stressing about whether you're "doing it right," you get a monthly action plan with checkboxes—complete the tasks, build wealth, move forward.

Your Pace, Your Goals: Whether you're aggressively paying debt, slowly building savings, or figuring out investing, Parity meets you where you are without judgment or one-size-fits-all advice.

Built for Where You Are

When you set a goal to save $50,000 in three years, Parity estimates whether that target is achievable based on the income and expense information you provide, and can suggest adjustments to your plan if needed. Actual outcomes depend on the accuracy of the information you enter and other factors.

Student loans that feel insurmountable: We prioritize payoff strategies alongside savings.

Analysis paralysis about investing: Clear next steps and guardrails replace guesswork.

Credit card debt you're tired of carrying: High‑impact, step‑by‑step payoff plans come first.

The Specs

What Parity Actually Does

Think of it as CFP-style guidance in your pocket - instead of paying hundreds or thousands for a one time plan, you get continuous automated guidance for a monthly fee often lower than popular streaming subscriptions.

Monthly Action Plans: Specific tasks like "Transfer $5,000 from savings to pay off Visa by July 30"—not generic suggestions

Complete Dashboard: All accounts synchronized—checking, savings, investments, credit cards, loans—with real-time net worth tracking

Priority System: Recommendations tagged High/Medium/Low so you tackle what matters first

Goal Tracking: Set goals from emergency funds to house down payments, with success probability calculations

What-If Scenarios: Test decisions before making them—"What happens if I take this job with lower salary but better benefits?"

Portfolio Matching: Find investments that match your actual risk tolerance, not questionnaire theater

Financial Q&A: Ask questions, get answers specific to your situation—no generic blog posts

What You Get

Within minutes of connecting accounts, you'll see your complete financial picture and get your first action plan—no waiting weeks for analysis.

Confidence in Decisions: Before making major moves—taking a new job, buying a car, moving cities—run the scenario in Parity to see the real financial impact.

Skill Building: As you complete action plans, you're learning personal finance through doing, not through reading articles you'll forget tomorrow.

Adaptable Planning: Life changes—income fluctuates, expenses spike, goals shift. Parity recalculates your plan automatically instead of becoming obsolete like static financial advice.

EXCLUSIVE SUBSCRIBER OFFER 🎉

Your First Month: FREE.

Thank You: This is our thank-you for being part of the Zillennial community — for reading Market Pulse, sharing feedback, and helping us shape what Parity became. You made this launch possible.

How To Get Started

What You'll Need to Get Started

You can save progress anytime and come back—Parity updates your plan as your info changes.

15–20 minutes, tops. Filling everything out the first time can take up to 20 minutes.

Bank & card logins (optional now, easy later). You can connect accounts or start with manual entry.

Income basics. Estimated monthly take‑home and (if applicable) benefits.

Debts. Balances, interest rates, and minimum payments.

Your goals. Emergency fund target, debt‑free date, down payment, etc.

Start Using Parity Today

Your financial plan starts here. Open the Parity App to explore your personalized dashboard and see your first set of actionable insights in minutes.

Need help or want a walkthrough of specific features? Click the User Guide for step-by-step support.

Parity is currently web-based, and our iOS app launches at the end of Q4 — so you’ll soon be able to manage everything right from your phone.

Closing Thoughts

We know some of you are disappointed about missing Market Pulse. We get it. But here's our promise:

Market Pulse will be back next quarter—and you'll be able to read it knowing you've already acted on your finances, not just learned about them.

Sometimes the best market analysis is having a plan regardless of what the market does.

Welcome to Parity. Welcome to action.

The Zillennial Team

Reply