- ZA's Pulse: Where Purpose, Strategy, and Impact Converge

- Posts

- Investment Pulse

Investment Pulse

Invest with purpose—your why and your ROI both count.

Investment Pulse

Your quarterly guide to purpose-driven investing, emerging trends, and accessible opportunities.

Hey Zillennial Fam!✨

If you skipped last week’s Market Pulse, take a quick peek here —we broke down the quarter’s biggest economic plot twists (student loan changes, tax cuts, labor market) and, more importantly, what they mean for your everyday money moves.

With that macro picture fresh, welcome to Investment Pulse, our quarterly deep dive into turning headline trends into smart portfolio decisions. This edition breaks down blockchain and digital assets—explaining in plain English how the tech works, various ways to get involved (from a low‑stakes ETF nibble to bold DeFi plays), and explores why some experts believe 2025 could be a significant year for mainstream adoption.

No hype, no jargon—just clear insights so you can say, “Okay, I actually get this.”

If you find value here, pass it along to a friend and invite them to subscribe so we can keep growing this community together.

Overview

🔎 What to Expect Today?

Three essential topics that build on each other: Think Different: What blockchain actually is (and isn't). Investment Spotlights: Every way to participate—from $1 to $1M. Future of Investing: Why 2025 is the tipping point.

Click any of the section links above to jump right to it.

🕒 Read Time: 7 minutes

Worth every second. By the end, we hope you'll understand more about digital assets than most people—including that friend who won't stop talking about Bitcoin.

Think Different

Let's Start With Why Everyone's So Confused 🤔

Here's what happened: A bunch of tech people created "internet money," it made some people rich, crashed a few times, and now suddenly banks and governments are all in. Meanwhile, you're sitting there wondering if you missed something important.

You didn't miss anything. You're just experiencing the gap between hype and understanding.

The truth: Blockchain technology is simultaneously overhyped (no, it won't solve world hunger) and underestimated (yes, it's actually changing how money works). Let's fix that confusion right now.

How Blockchain Actually Works 💡

The concept: Imagine a spreadsheet that thousands of computers share, where everyone can see every transaction, but no one can cheat or delete anything. That's blockchain—a permanent, transparent record that doesn't need a bank to manage it.

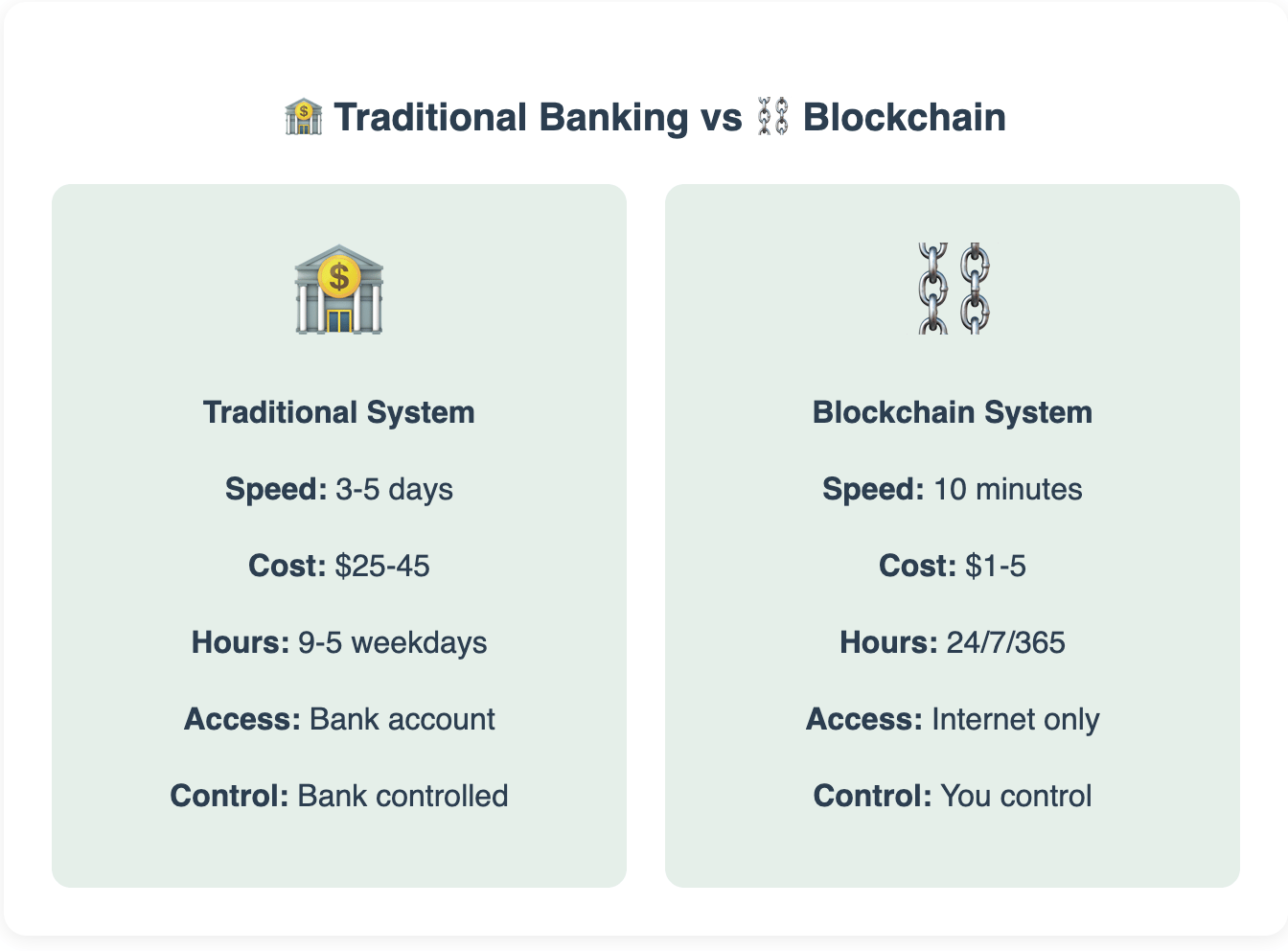

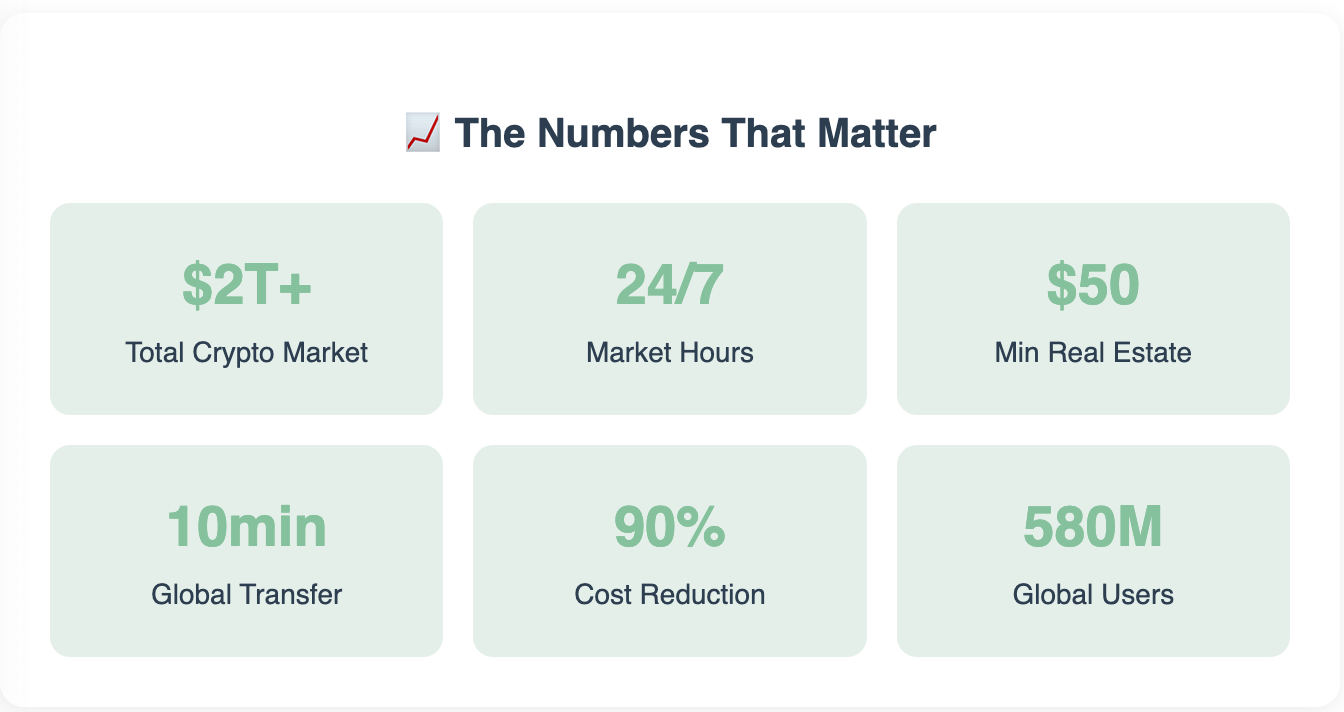

Why this matters: For the first time in history, we can transfer value digitally without trusting a middleman. No banks. No payment processors. No "sorry, international transfers take 5 days."

The breakthrough insight: Blockchain isn't about technology—it's about removing gatekeepers from finance.

Breaking Down the Buzzwords 📚

Bitcoin: Digital gold. Limited supply (only 21 million ever), no government control, transfers anywhere in 10 minutes. First and biggest, but just the beginning.

Ethereum: The app store of blockchain. While Bitcoin is digital money, Ethereum runs programs (smart contracts) that automate everything from loans to art sales.

Smart Contracts: "If this, then that" code that executes automatically. If you pay rent, you get access. If conditions are met, payment releases. No lawyers, no delays.

NFTs: Digital ownership certificates. Yes, some are overpriced JPEGs. But the technology proves ownership of anything digital—art, music, tickets, credentials.

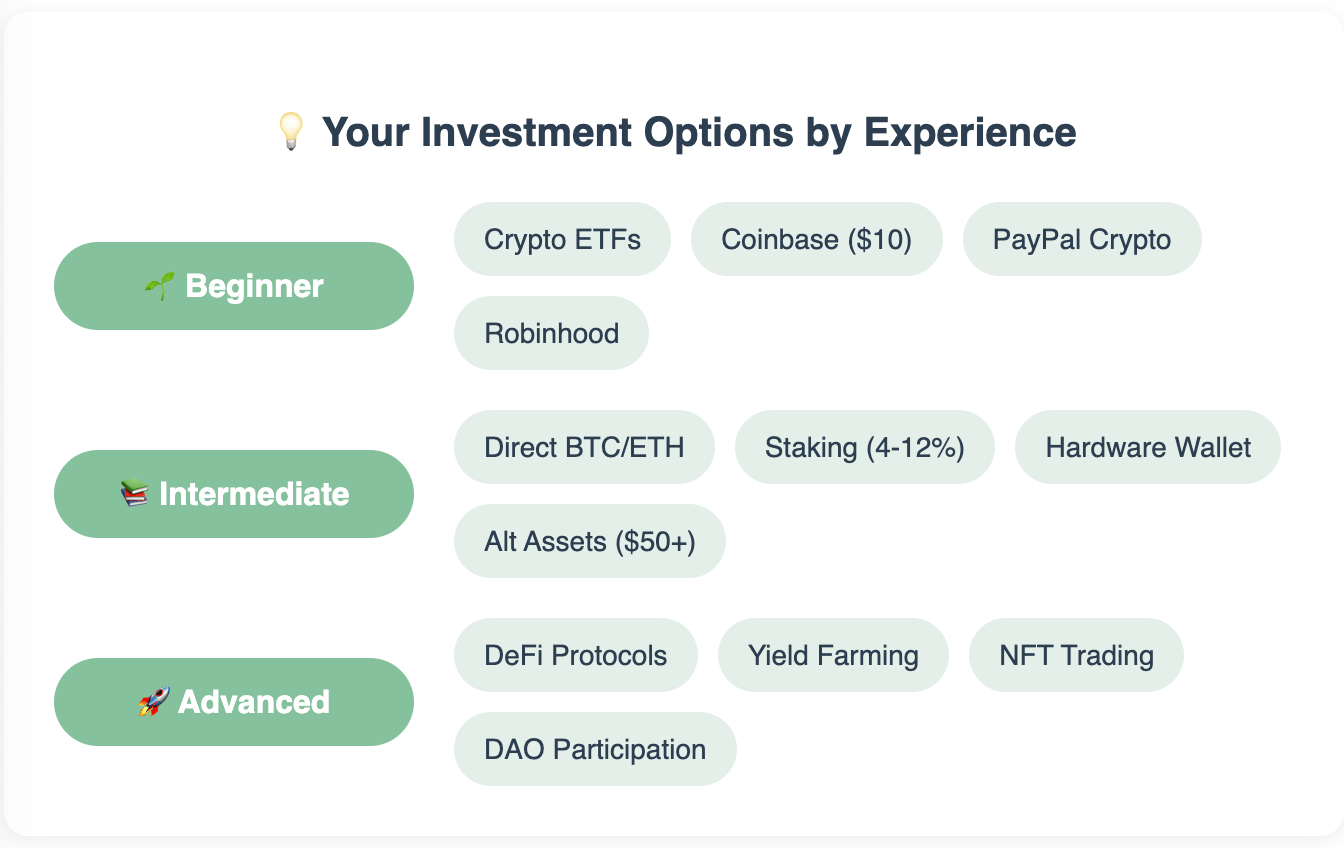

DeFi: Banking without banks. Lending, borrowing, trading—all peer-to-peer. Higher yields, lower fees, but higher risks.

Web3: The internet where you own your data and content. Instead of platforms profiting from your posts, you do.

What Can You Actually Do With This Stuff? 🛠️

Real applications today:

Financial Services: Cross-border payments in minutes, 24/7 markets, yield opportunities, borrowing against digital assets

New Investment Access: Fractional real estate and art ownership, direct creator support, previously restricted asset classes

Emerging Tech: Gaming assets, digital identity, DAOs for governance, automated smart contracts

OK, But What About the Risks? ⚠️

The Legitimate Concerns: Crypto prices swing wildly (20% daily moves aren't unusual), lose your password = lose your money forever, scammers prey on confusion and FOMO, regulations are still evolving, and some blockchains have an environmental impact.

The Misconceptions: "It's all gambling" (speculation ≠ the technology), "Only criminals use it" (less than 1% is illicit vs 2-5% of GDP), "It has no real value" (JPMorgan processes $2B daily), and "It's too late" (we're in year 2 of a 20-year transformation).

The balanced view: Blockchain is a powerful technology with real risks. Understanding both is how you make informed decisions.

Investment Spotlights

Now that you understand what blockchain IS, let's explore every way to participate—from ultra-safe to cutting-edge. Remember: This is education, not advice. Your journey depends on your goals, risk tolerance, and circumstances.

The Traditional Route (Start Here If Cautious)

What: Blockchain exposure through your existing brokerage

Crypto ETFs: Buy Bitcoin/Ethereum exposure like stocks (IBIT, FBTC)

Blockchain Stock ETFs: Invest in companies building the tech (BLOK, BLCN)

Individual Stocks: Coinbase, MicroStrategy, Block (Square)

Perfect for: IRA/401k investing, cautious beginners, avoiding crypto taxes

Reality check: Lower returns than direct ownership but much simpler

Direct Ownership (The Real Thing)

What: Actually buying and holding cryptocurrencies

Beginner Exchanges: Coinbase, Kraken (user-friendly, insured)

Integrated Apps: Robinhood, PayPal, Cash App (super simple)

Advanced Platforms: Binance, KuCoin (more assets, features)

Start with: $10 in Bitcoin/Ethereum to learn the process

Key skill: Understanding wallets and security

Alternative Assets (The Innovation Zone)

What: Real-world assets on blockchain

Asset Type | Platform Examples | Minimum | What You Get |

|---|---|---|---|

Real Estate | $50 | Rental income shares | |

Fine Art | $20 | Blue-chip art fraction | |

Startups | $100 | Early-stage equity | |

Music Royalties | $50 | Song revenue share |

The opportunity: Access investments previously requiring millions

Yield Generation (For Income Seekers) Options

Conservative: Stablecoins can potentially earn yields, which have historically ranged from 5-8% on platforms like Coinbase and Gemini. However, these yields are subject to change based on market conditions.

Moderate: Staking major cryptos for 4-12% (Ethereum, Solana)

Advanced: DeFi protocols offering 10-20%+ (higher risk)

Compare to: Savings accounts at 0.5%, CDs at 5%

Future of Investing

Why Everything Changed in 2025 🚀

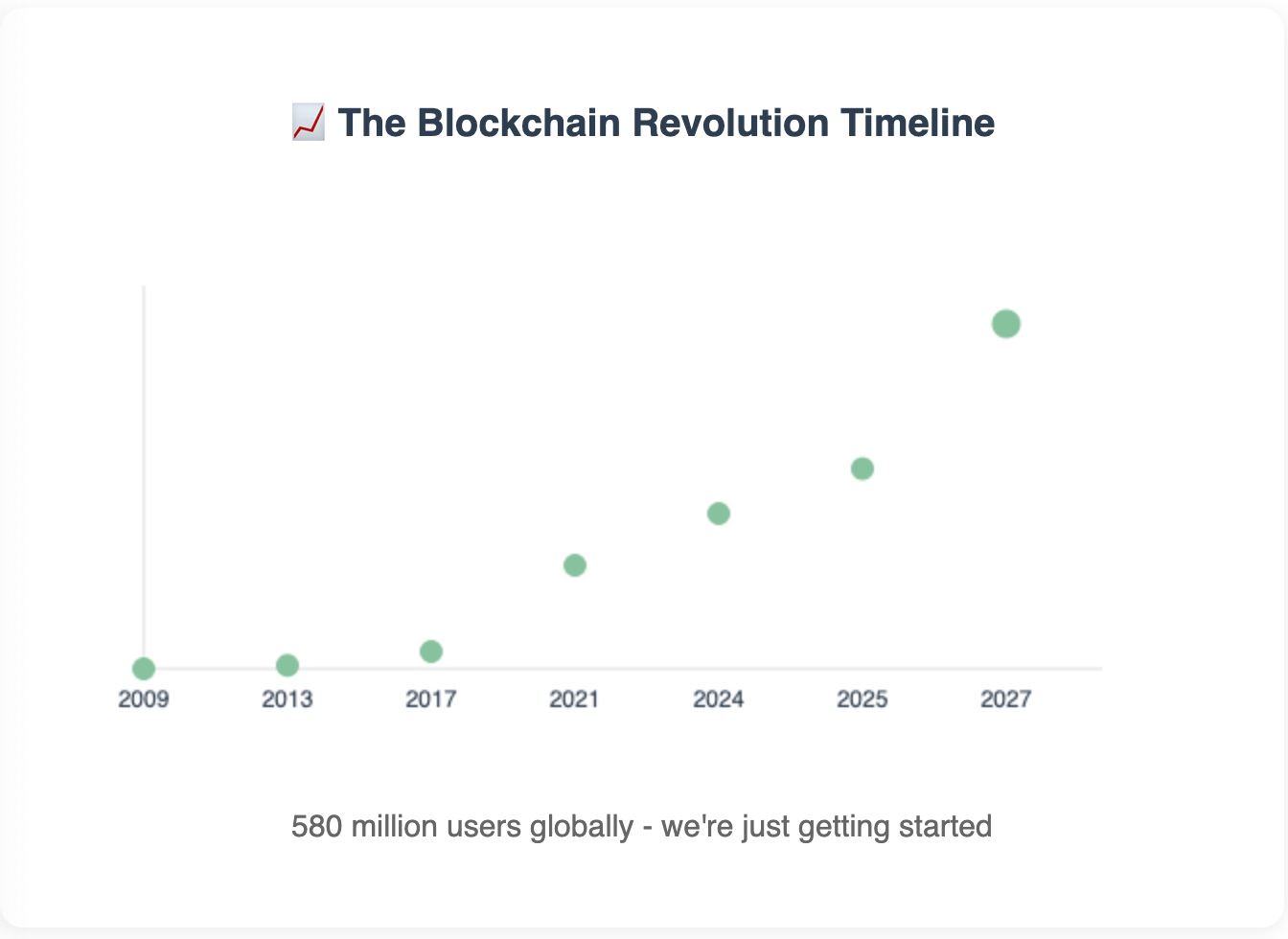

For 15 years, blockchain was the "interesting experiment." Then three things happened simultaneously that changed everything:

The tech finally works: Fast, cheap, user-friendly

The money arrived: $17 billion from institutions in Q1 alone

The rules got clear: U.S. passed landmark crypto legislation

This isn't another crypto boom. This is infrastructure becoming real.

The Tech Breakthrough That Changes Everything ⚡

Remember dial-up internet? That was blockchain until recently. Now we've got broadband:

Transaction costs: Reduced from $50 to $0.50, although costs may vary based on network conditions and other factors.

Speed boost: From 15/second to 100,000/second

User experience: Actually good (finally!)

Reality check: Visa does 65,000/second—blockchain now matches that

What's next: Costs dropping another 90% this year

The bottom line? The infrastructure you've been waiting for is here.

Following the Smart Money 💰

Who's actually building on blockchain now:

Institution | What They're Doing | Scale |

|---|---|---|

JPMorgan | Processing tokenized transactions | $2B daily |

BlackRock | Tokenized money market fund | $2B+ AUM |

Visa | Stablecoin payment settlement | Millions daily |

BNY Mellon | Digital asset custody | $4.3T institution |

The signal: When institutions managing more money than most countries' GDP adopt blockchain, they're not experimenting—they're building the future financial system.

New Rules, New Game 📜

We get it—regulation talk isn't thrilling, but this actually matters:

GENIUS Act: Banks can issue digital dollars, consumer protections required, clear oversight framework

CLARITY Act: Defines security vs commodity, no more guessing games, developer protections

Global race: EU, UK, Singapore all creating frameworks

The Wild West era? Officially over—and that's exactly what we needed for real adoption.

Beyond Trading: Where This Actually Matters 🌍

Blockchain solving real problems:

Supply Chains: Walmart tracks food contamination in 2 seconds (was 7 days)

Healthcare: Secure patient records, drug verification

Energy: Peer-to-peer solar trading, carbon credits

Identity: You control your data, instant verification

Finance: Instant settlement, fractional ownership, global access

The pattern: Wherever trust, transparency, and efficiency matter, blockchain delivers.

Closing Thought

We started with your confusion about crypto, blockchain, and Web3. Hopefully, we've replaced that confusion with understanding.

Here's what matters: This technology isn't about getting rich quick or replacing everything that exists. It's about building financial infrastructure that's more open, efficient, and accessible than what came before.

You don't need to become a crypto trader. You don't need to buy anything. You just need to understand the system being built—because you'll be working within it for the next 30 years.

With clarity and purpose,

The Zillennial Advisors Team

P.S. If this helped clarify digital assets, share it with someone else who's confused but curious. Understanding multiplies when shared.

IMPORTANT DISCLAIMERS:

Educational Purpose Only: This newsletter is for educational and informational purposes only. It does not constitute investment advice, financial advice, or any other type of advice. Do not make investment decisions based solely on this newsletter.

No Recommendations: Nothing in this newsletter constitutes a solicitation, recommendation, or endorsement to buy or sell any financial instruments or digital assets.

Risk Disclosure: Digital assets are highly volatile and risky. You can lose your entire investment. Never invest more than you can afford to lose.

Regulatory Notice: The Zillennial Advisors is an SEC-registered investment advisor. Registration does not imply a certain level of skill or training.

Accuracy: Information about rapidly evolving technologies may become outdated. Regulatory information current as of July 2025.

No Professional Relationship: Reading this newsletter does not create an advisor-client relationship.

Reply