- ZA's Pulse: Where Purpose, Strategy, and Impact Converge

- Posts

- Market Pulse

Market Pulse

Overwhelmed by Headlines? Your Bite-Sized Guide to Clarity

Market Pulse

Your quarterly guide to government shifts, global affairs, and economic trends—cutting through the noise with bite-sized insights that make headlines less overwhelming.

🌟 Hey Zillennial Fam,

Let's be real—Q2 2025 just broke every rule in the book.

We get it—Q2 2025 was a lot to process. Trade policies shifted overnight, spending bills introduced new programs that could reshape your career path, and the housing market sent mixed signals that probably left you wondering what's actually happening.

The headlines have been relentless, and honestly? It's exactly the kind of quarter where tuning out feels tempting. But when policies change this fast, staying informed isn't optional—it's how you protect what you've built and plan for what comes next.

That's why we've broken down this quarter's developments into clear, actionable insights. We're cutting through the noise to show you what actually matters for your money, your career, and your future. No drama, no jargon—just the analysis you need to make smart decisions.

Ready to turn Q2's chaos into clarity? Let's dive in..

Overview

🔎 What to Expect?

We’ll break down major developments in three key areas shaping today's financial landscape: Government & Policy, International Relations, and Economic Trends. You can navigate directly to the sections that interest you most.

🕒 Read Time: 15 minutes

This isn't a quick skim – it's designed for a thoughtful read during your morning coffee or commute. We respect your inbox and your time, which is why we send this newsletter out only once per quarter.

📅 What's Next?

Keep an eye out for our next Investment Pulse coming next week!

Government and Policy

Quick Facts 📈

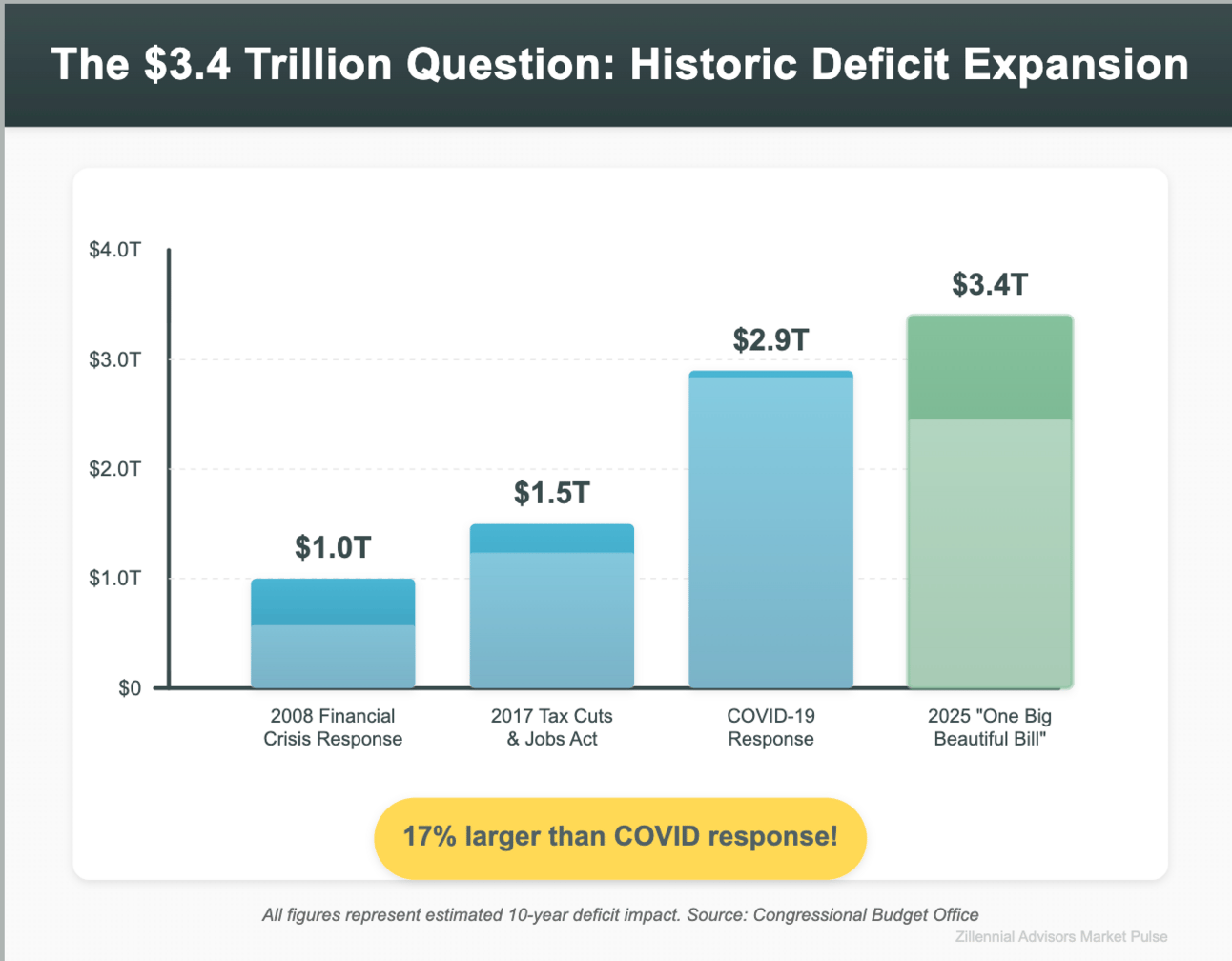

Historic Tax Package: House passed H.R.1 "One Big Beautiful Bill Act" July 3, adding an estimated $3.4 trillion to the deficit for tax cuts and spending changes

Student Loan Bombshell: Economic hardship deferments eliminated for loans after July 2025, affecting future borrowers during financial crises

Healthcare Cliff: ACA premium subsidies set to expire December 2025, removing financial assistance for millions of Americans currently receiving coverage

No Tax on Tips/Overtime: Temporary deductions worth $1,500-2,000 annually for service workers through 2028

Investment Fast-Track: Executive order establishing "United States Investment Accelerator" launched March 31 to streamline investments above $1 billion

Our Insight 🧐

Deficit Gamble: The $3.4 trillion deficit expansion signals a significant shift toward supply-side economics. While there is potential for inflationary pressure if spending outpaces growth, there could also be economic benefits if business investment increases.

Education Risk Reset: Eliminating hardship deferments creates a dangerous precedent: future graduates face bankruptcy or default as their only options during recessions, fundamentally altering the risk profile of higher education

Healthcare System Shock: The subsidy expiration could potentially lead to rural hospital closures and coverage gaps for many. Without insurance, individuals might increasingly rely on emergency rooms for primary care, which could drive up costs for those with coverage.

Service Worker Symbolism: Service worker tax breaks are politically savvy but economically limited—$2,000 annually doesn't offset healthcare costs or housing inflation, making this more symbolic than substantive

Corporate Fast Lane: The Investment Accelerator's $1 billion threshold favors mega-corporations over small businesses, potentially accelerating market consolidation while promising faster regulatory approvals

What Does This Mean For You? 🎯

Budget Reality Check: With $3.4 trillion in new deficit spending, expect interest rates to stay elevated longer than predicted—if you're planning major purchases like homes or cars, factor in higher borrowing costs through at least 2027

Graduate School Reality Check: If you're applying to grad school for Fall 2026, consider calculating worst-case loan payments assuming zero deferment options

Health Insurance Decision Time: If you're on ACA plans, it may be time to evaluate whether employer coverage, spouse's plan, or alternative options make more sense before subsidies disappear

Service Worker Action Plan: If you work for tips, consider automating that $150-200 monthly tax break into a high-yield savings account—it might be wise to treat it as money you never had since the benefit expires in 2028

Local Business Impact: Watch how mega-deals reshape your community: when billion-dollar investments bypass small businesses, expect fewer local suppliers, contractors, and service providers

Regulatory Developments

Quick Facts 📈

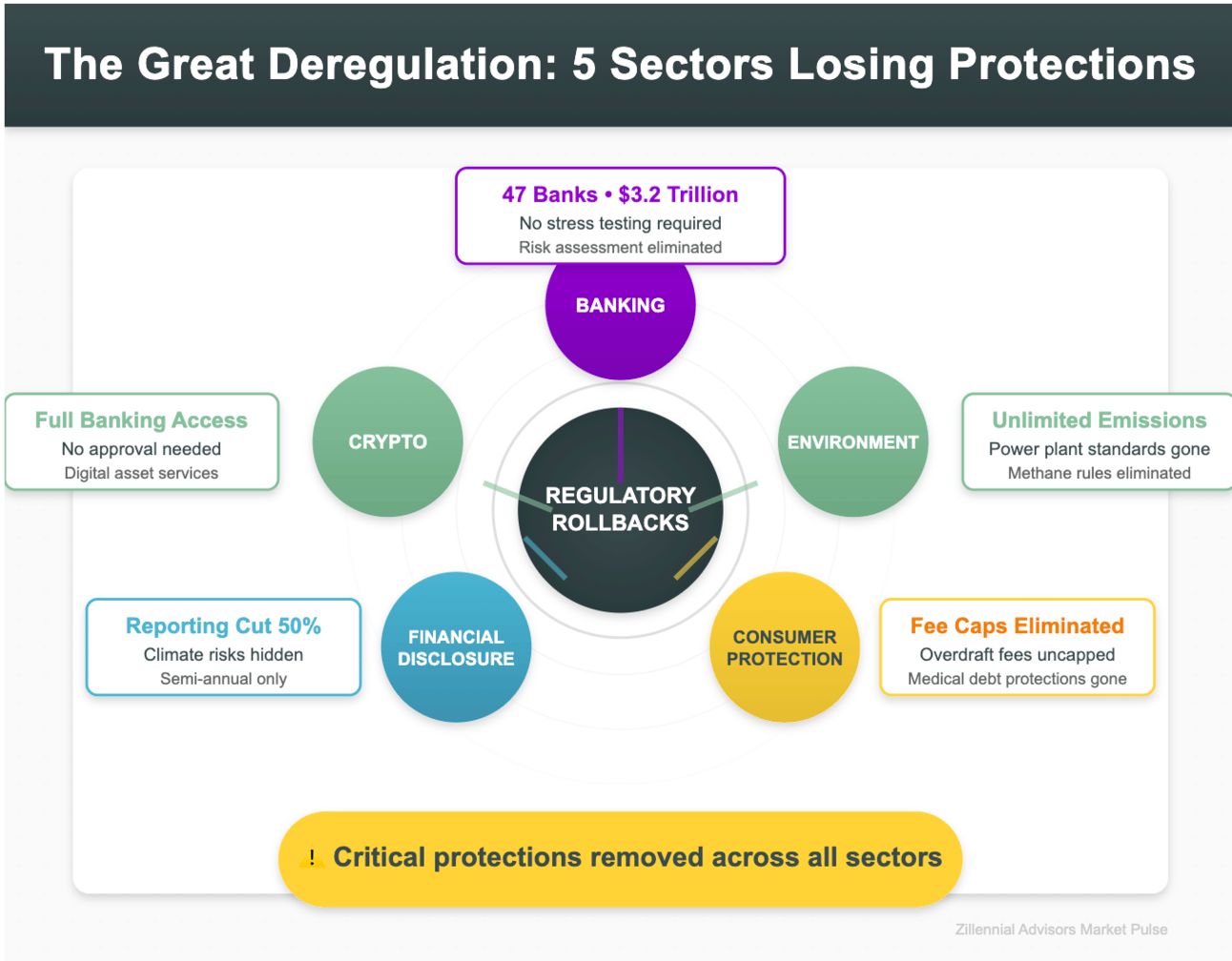

Changes in Banking Regulations: The Fed/OCC has adjusted stress test requirements for mid-size banks under $250B—47 regional banks managing $3.2 trillion.

EPA Emissions Rollback: Power plant emission standards and methane rules withdrawn—fossil fuel facilities can pollute without previous limits

SEC Disclosure Reversal: Climate risk reporting suspended + quarterly reports cut to semi-annual for companies under $10B market cap

CFPB Protections Killed: Trump signed S.J.Res. 18 nixing overdraft caps; courts killed medical debt and late fee protections

Crypto Green Light: Banks can now offer digital assets without regulatory approval—previous crypto guidance reversed

Our Insight 🧐

Banking Time Bomb: Eliminating stress tests for banks holding $3.2 trillion may lead to conditions similar to those before 2008, as these 47 institutions can now potentially take bigger risks without proving they can survive economic shocks.

Climate Cost Shift: High levels of emissions can lead companies to externalize pollution costs to communities, potentially resulting in higher healthcare bills, property damage from extreme weather, and agricultural disruptions without corporate accountability

Information Blackout: Cutting reporting frequency and climate disclosures creates dangerous blind spots—investors lose critical data while companies facing climate risks can hide vulnerabilities until crisis hits

Fee Frenzy Returns: Without CFPB protections, expect cascading charges—overdrafts averaging $35 trigger late fees, credit score hits, and higher interest rates, creating poverty traps for paycheck-to-paycheck workers

Crypto Casino Opens: Banks diving into digital assets without oversight recreates conditions that spawned FTX and Terra—traditional banking protections won't apply when your checking account offers Bitcoin trading

What Does This Mean For You? 🎯

Regional Bank Reality: If you bank with institutions under $250 billion, consider diversifying accounts. Without stress tests, diversification can be a smart strategy to manage potential risks associated with varying levels of regulatory scrutiny

Environmental Health Costs: Living near power plants or industrial areas? Consider investing in air purifiers and water filters—with emission limits gone, respiratory issues and contamination risks may spike in industrial communities

Investment Blind Spots: If you own stocks in companies under $10B market cap, be aware that these companies may report less frequently, which could affect the availability of information. Consider whether holding investments with semi-annual reporting aligns with your risk tolerance and investment strategy

Overdraft Defense Strategy: With fees uncapped again, consider switching to banks that still offer low-fee overdraft protection voluntarily—credit unions and online banks often provide better terms than traditional institutions

Crypto Caution Zone: Your local bank may soon pitch crypto services—remember these lack FDIC protection, so never put emergency funds or essential savings into digital assets offered through traditional banking channels

Digital & Technology Policy

Quick Facts 📈

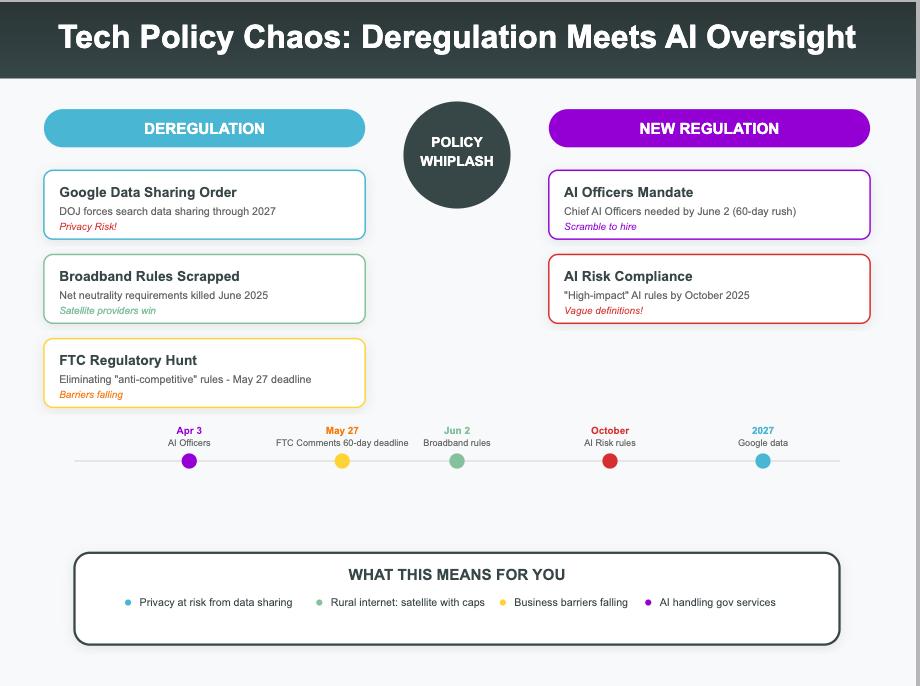

Google Data Sharing Order: DOJ forces Google to share search data with competitors through 2027—antitrust remedy

Broadband Rules Scrapped: NTIA killed BEAD net neutrality/data cap requirements June 2025

Regulatory Review Launch: FTC hunting anti-competitive federal rules—public comments through May 27, 2025

AI Officers Mandate: OMB memo M-25-21: agencies need Chief AI Officers within 60 days of April 3

AI Risk Requirements: Agencies must manage "high-impact" AI affecting rights/safety by October 2025

Our Insight 🧐

Search Engine Shake-Up: Mandating Google to share its data may introduce privacy challenges and could influence competitive dynamics. This situation might lead to legal disputes and uncertain changes in market competition

Rural Broadband Revolution: Removing net neutrality requirements means satellite providers like Starlink can now compete for billions previously reserved for fiber—rural areas might get faster connectivity but with usage caps

Deregulation Theater: FTC's regulatory review signals agencies hunting for rules to eliminate—watch for rollbacks in healthcare, finance, and environmental sectors disguised as "promoting competition"

AI Accountability Rush: The 60-day deadline for Chief AI Officers means agencies are scrambling to hire without clear frameworks—expect inconsistent standards and turf battles over AI governance

Rights vs. Innovation: "High-impact" AI definitions remain vague, creating compliance nightmares—agencies will either over-regulate innovation or under-protect citizens' rights until courts clarify boundaries

What Does This Mean For You? 🎯

Privacy Trade-Offs Ahead: If you use Google Search, your query data might be shared with competitors by 2027—consider diversifying search engines now or adjusting what personal information you search for online

Rural Internet Reality Check: If you're waiting for rural broadband, expect satellite options to dominate BEAD funding—prepare for potential data caps and weather-related outages instead of unlimited fiber connections

Business Opportunity Window: With FTC reviewing anti-competitive regulations, watch for barriers falling in your industry—licensing requirements, market restrictions, or compliance costs that blocked new entrants might disappear by year-end

Government AI Interactions: When dealing with federal agencies after October, there may be increased use of AI systems for initial reviews of benefits, permits, or applications. It is advisable to document everything as the accountability structures may not be fully established

Innovation vs. Protection Gap: If you work in AI development, the vague "high-impact" definitions create legal minefields—consider focusing on clearly low-risk applications until regulatory boundaries become clearer through enforcement actions

Energy & Climate Initiatives

Quick Facts 📈

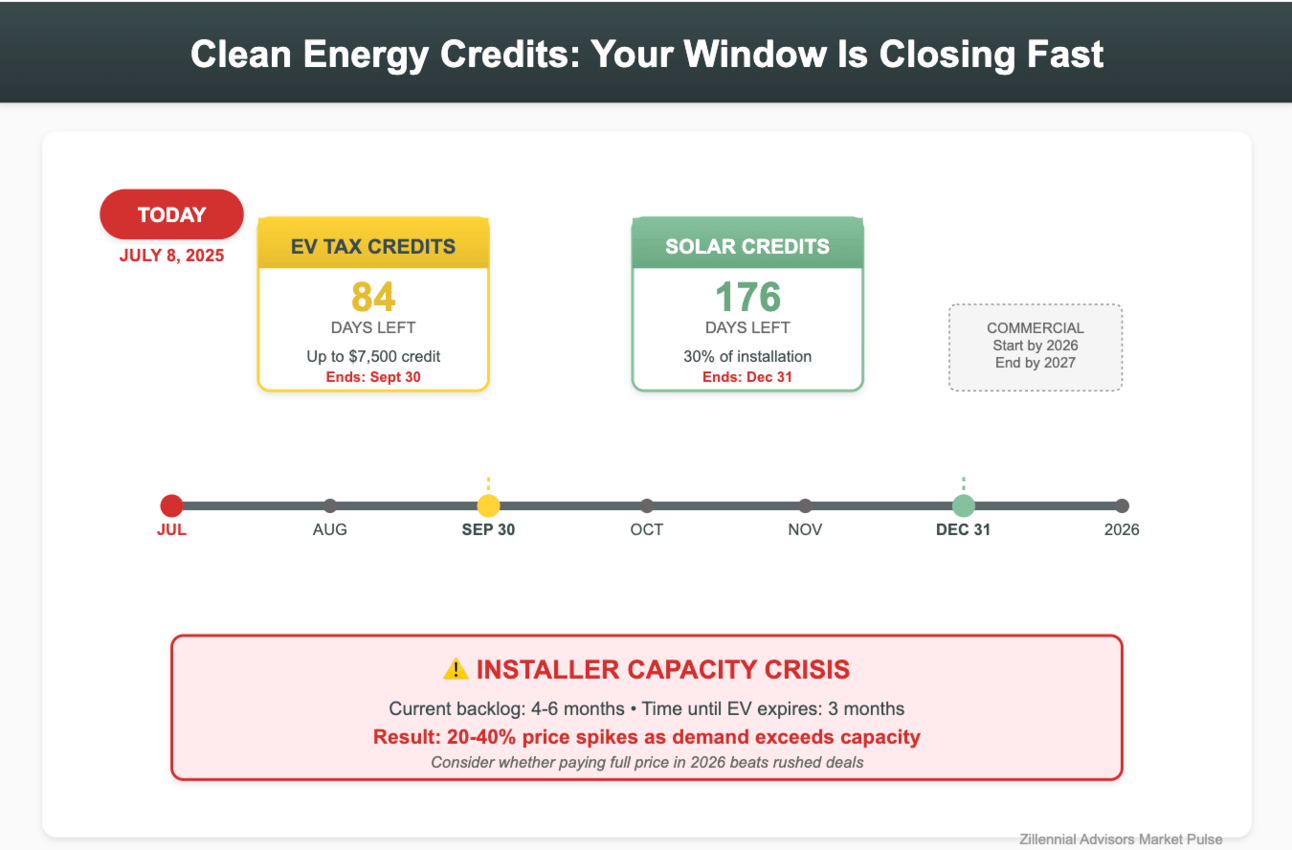

Clean Energy Cliff: OBBBA kills EV credits Sept 30, 2025; residential solar Dec 31, 2025; commercial wind/solar must start by 2026, finish 2027

Coal Promotion Order: Trump EO 14266 "Reinvigorating America's Beautiful Clean Coal Industry" April 8—agencies must prioritize coal

Methane Rules Reversed: EPA killed oil/gas leak detection requirements June 8—all methane standards gone

Efficiency Standards Axed: DOE scrapping standards May 16 for refrigerators, ACs, washers + 9 categories

CAFE Fines Eliminated: OBBBA removes fuel economy penalties—potentially saving billions for automakers

Our Insight 🧐

Rush-Buy Chaos: Credit deadlines create impossible timelines—September 30 for EVs and December 31 for residential solar mean installers face 6-month backlogs compressed into 3 months, guaranteeing price spikes

Coal's Pyrrhic Victory: Promoting coal while markets abandon it signals political theater over economics—utilities know coal plants closing faster than opening regardless of federal cheerleading

Methane Money Bomb: Eliminating leak detection saves oil companies millions but creates invisible climate costs—undetected leaks mean higher greenhouse gases and potential explosion risks near communities

Appliance Price Paradox: Scrapping efficiency standards might lower sticker prices by 5-10% but double lifetime operating costs—manufacturers will shift to the cheapest designs, not the best value

Gas Guzzler Renaissance: Without CAFE penalties, expect automakers to abandon efficiency investments—SUVs get bigger, mileage gets worse, and American brands fall further behind global competitors

What Does This Mean For You? 🎯

Credit Deadline Reality: With EV credits ending September 30 and solar December 31, booking now might already be too late—consider whether paying full price in 2026 makes more sense than rushing into bad deals

Coal Community Impact: If you live near proposed coal projects, expect property value debates—new coal facilities face financing challenges despite federal support, creating uncertainty without actual development

Gas Leak Vigilance: Living near oil/gas facilities without methane monitoring creates health risks—consider installing home air monitors and documenting unusual odors or health symptoms for potential legal action

Appliance Shopping Math: Without efficiency standards, calculate total ownership costs before buying—that $400 "bargain" refrigerator might cost $2,000 more in electricity over 10 years than efficient models

Vehicle Purchase Timing: With CAFE fines gone, fuel-efficient models may disappear from lots—if mpg matters to your budget, consider buying efficient vehicles before automakers pivot to profitable gas guzzlers

Social Policy Changes

Quick Facts 📈

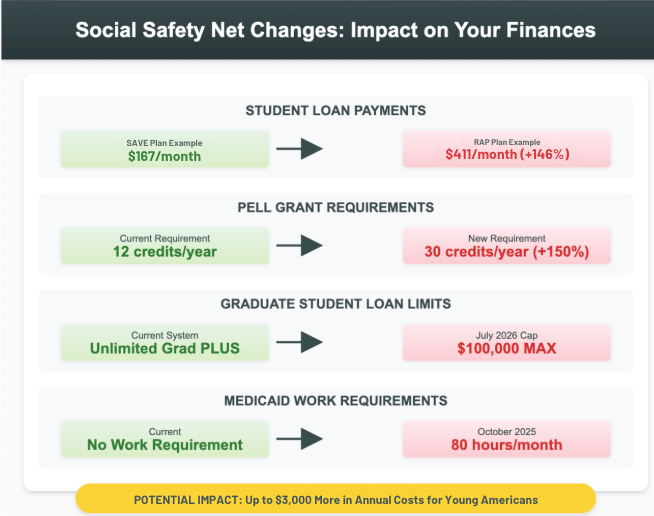

Student Loan Shock: New RAP plan estimated to cost $2,929 more annually than SAVE—8 million borrowers affected

Pell Grant Cuts: Full-time jumps from 12 to 30 credits yearly; 1 million students lose eligibility on new requirements

Federal Loan Caps: July 2026: undergrads $50K (from $31K); grad students $100K; med/law $200K; Grad PLUS eliminated

Medicaid Work Requirements: 80 hours monthly starting October 2025—CBO projects 4.8 million lose coverage year one

Trump Accounts Created: $1,000 federal deposit for U.S. births 2025-2029, invested in index funds until age 18

Our Insight 🧐

Debt Trap Expansion: RAP's $2,929 annual increase hits hardest at $30,000-60,000 earners—the sweet spot of young professionals drowning in rent who now face impossible choices between loan payments and basic needs

Academic Acceleration Penalty: Requiring 30 credits for full-time status forces students into overload schedules—expect higher dropout rates as working students can't balance impossible course loads with jobs

Medical School Math Crisis: With average medical school debt at $212,000, the $200,000 federal cap forces future doctors into private loans at 12%+ rates—expect fewer primary care physicians as only lucrative specialties can repay crushing debt

Healthcare Cliff Effect: 80-hour work requirements ignore gig economy reality—millions juggling multiple part-time jobs without benefits lose Medicaid precisely when employer coverage remains unavailable

Generational Wealth Theater: The initial $1,000 investment in Trump Accounts is projected to grow based on historical market averages, potentially reaching $8,000 over 18 years. However, considering current college costs, which can exceed $200,000, this program offers limited assistance for a single generation of beneficiaries

What Does This Mean For You? 🎯

Loan Payment Reality Check: If you're on the SAVE plan, be aware that payments could potentially increase significantly when forced to the RAP plan. Consider evaluating whether an aggressive payoff now might be more beneficial than facing potentially higher payments over the long term.

College Credit Crunch: Current students needing Pell Grants must take 30 credits (10 courses) yearly to qualify—evaluate whether graduating faster with debt beats losing aid trying to work while studying

Graduate School Funding Crisis: With Grad PLUS ending July 2026 but a 3-year grace period for existing borrowers, if you started MBA/grad school with Grad PLUS before June 2026, you can continue through graduation—new students face $100,000 federal cap forcing private loans

Medicaid Documentation: If you work gig economy or multiple part-time jobs, start tracking every hour now—without employer verification, proving 80 hours monthly becomes your full-time administrative burden

Baby Account Perspective: If expecting between 2025-2029, Trump Accounts provide nice starter funds—but don't confuse $1,000 seed money with actual college savings; consider maxing out 529 plans first for real tax advantages

International Relations

Global Trade Developments

Quick Facts 📈

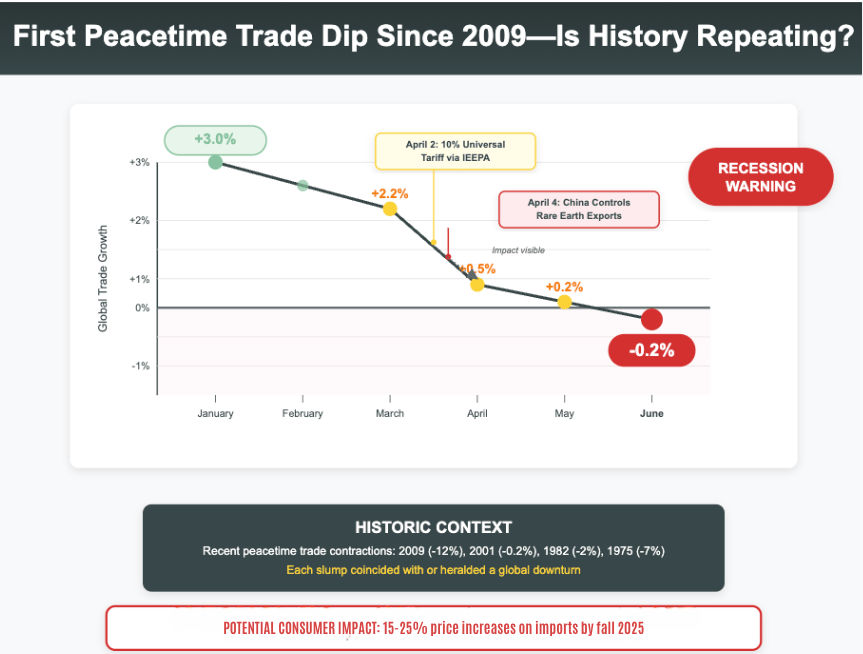

US Tariff Bombshell: Trump's 10% universal baseline tariff April 2, 2025 hits $3.4 trillion annual imports via IEEPA emergency declaration

Trade Forecast Slashed: WTO April outlook: 0.2% drop in 2025 merchandise trade—first contraction since 2020

Geneva Agreement Pause: US-China détente May 12: China resumes rare earths for eased chip restrictions

Critical Minerals Weapon: China's MOFCOM controls seven heavy rare earths April 4—affects $45B tech manufacturing

Trade Volumes Collapse: WTO cuts 2025 forecast from +3.0% to -0.2% June 20—first non-crisis contraction in 40 years

Our Insight 🧐

Emergency Powers Gambit: Using IEEPA for tariffs weaponizes national security law for trade policy—expect potential years of court battles with businesses facing increased compliance costs, and consumers experiencing higher prices

Recession Signal Flashing: WTO's trade contraction forecast historically precedes global recessions by 6-12 months—slowing trade means factory closures, job losses, and economic pain spreading worldwide

Temporary Theater: Geneva's rare earth deal papers over fundamental conflicts—China maintains export controls as "national security" while U.S. faces 6-month stockpiles of critical minerals needed for defense

Resource Weapon Deployed: China's rare earth controls demonstrate Beijing's willingness to cripple Western tech manufacturing—controlling 85% of processing means they set terms for electric vehicles, wind turbines, and missiles

Deglobalization Accelerates: First peacetime trade contraction signals permanent shift—companies abandoning efficient global supply chains for expensive domestic production, guaranteeing higher prices for decades

What Does This Mean For You? 🎯

Import Price Shock: With 10% universal tariffs plus country-specific rates, expect everyday imports to cost 15-25% more by fall—stock up on electronics, appliances, and clothing before prices fully adjust

Job Market Upheaval: Trade contraction means manufacturing job losses despite reshoring promises—if you work in import-dependent industries, consider updating skills for domestic-focused sectors before layoffs hit

Tech Product Scarcity: Geneva deal notwithstanding, rare earth uncertainties mean potential shortages of phones, EVs, and electronics—consider buying tech products now before supply chains fully adjust

Investment Rebalancing: Consider reviewing your portfolios for exposure to global supply chain dependent stocks, as shifts in global trade dynamics may impact their performance

Currency Volatility Ahead: Trade wars create wild currency swings affecting travel, imports, and savings—if planning international purchases or trips, consider locking in rates now before further deterioration

Geopolitical Economic Impacts

Quick Facts 📈

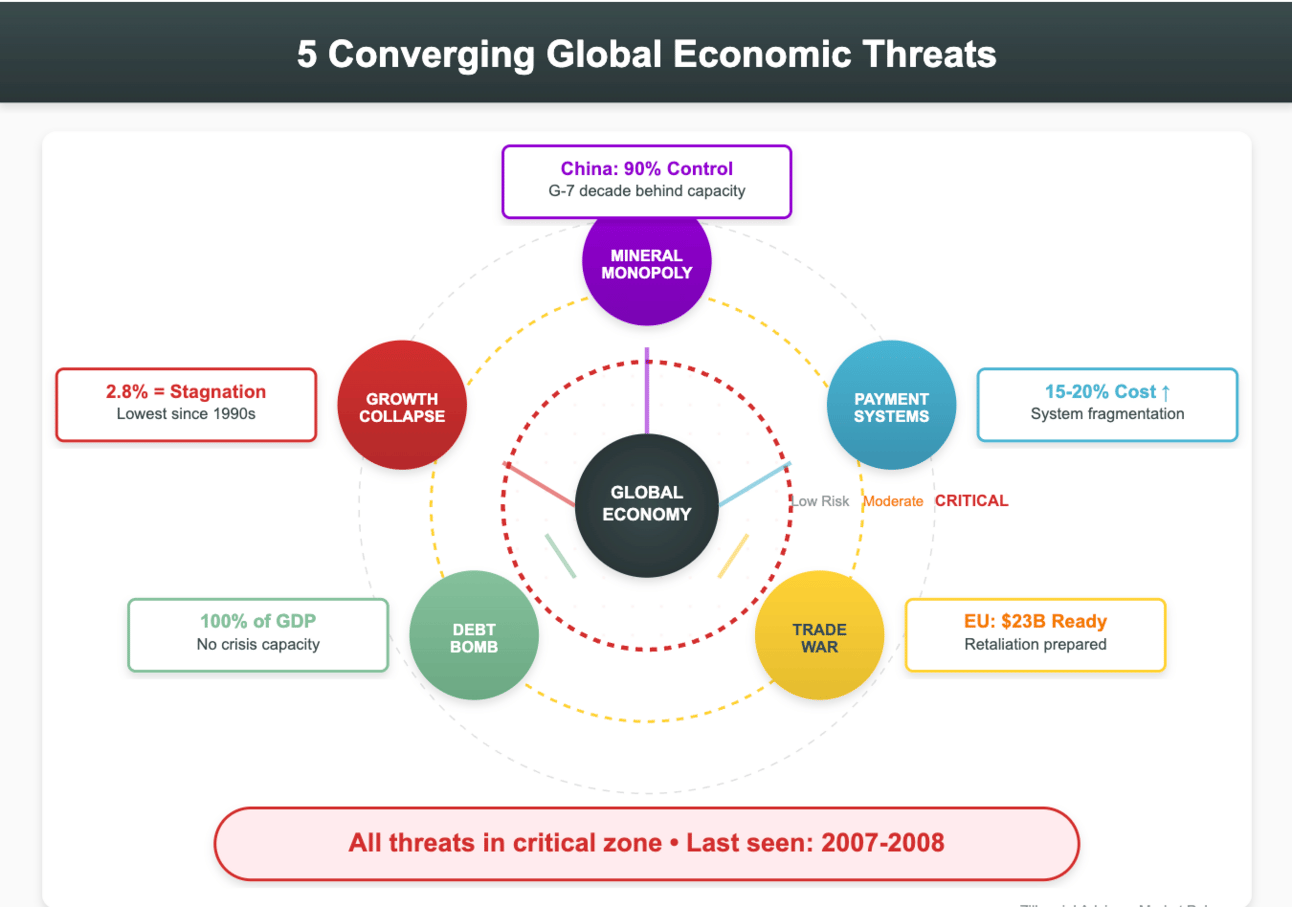

G-7 Minerals Alliance: Critical Minerals Action Plan June 17 counters China's 90% rare earth processing monopoly

Payment System Warning: BIS Annual Report: tariff fragmentation splinters payment rails, raises cross-border costs 15-20%

EU Retaliation Ready: EU paused tariffs 90 days matching US, prepared $23B countermeasures on American agriculture/tech

Debt Bomb Ticking: World Bank/IMF: global public debt hitting 100% GDP by decade's end—highest peacetime level ever

Growth Collapse: IMF April WEO cuts 2025 global GDP to 2.8% on tariff uncertainty—lowest non-recession forecast since 1990s

Our Insight 🧐

Mineral Coalition Building: G-7 plays desperate catch-up to China's 30-year head start—alternative supply chains need decade-long investments, uncertain returns

Financial Balkanization: BIS warning = end of unified payments—separate dollar/euro/yuan systems with expensive bridges make international business prohibitive

Retaliation Roulette: EU's $23B targets American farmers/tech for political pressure—pause masks agricultural devastation prep for swing states

Debt Spiral Accelerating: 100% debt-to-GDP = no crisis ammunition—recession brings austerity not stimulus, deepening pain

Stagnation Scenario: 2.8% growth barely covers population—minus inflation = zero real per-capita growth, lost decade ahead

What Does This Mean For You? 🎯

Tech Upgrade Timing: With G-7 scrambling for mineral alternatives, expect 2-3 year shortage of electronics components—if planning major tech purchases, consider buying before supply constraints fully materialize

International Payment Costs: As payment systems fragment, international wire fees could jump from $50 to $200+—if you regularly send money abroad, explore cryptocurrency alternatives before traditional channels become prohibitive

Food Price Preparation: If there are changes in trade relations between the EU and the US it could potentially impact food prices. Consider staying informed about market developments and exploring local food sources as a precautionary measure

Debt Crisis Positioning: With governments approaching fiscal limits, future bailouts unlikely—prioritize debt reduction and avoid leveraged investments that assume government backstops during downturns

Career Recession-Proofing: 2.8% global growth means hiring freezes and layoffs spreading beyond tech—consider developing skills in essential services (healthcare, utilities, food) that maintain demand during stagnation

Regional Economic Alliances

Quick Facts 📈

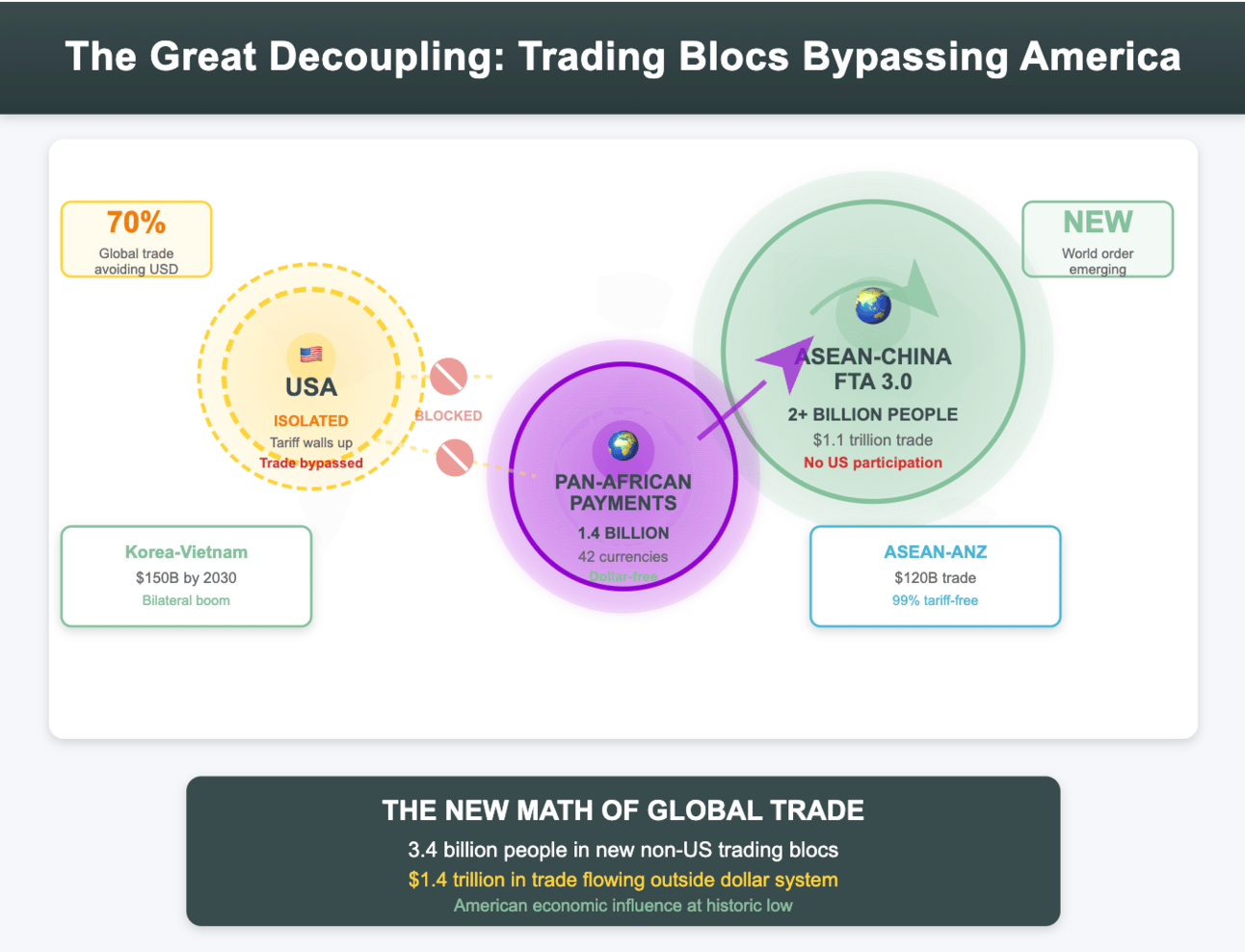

Asia Mega-Deal: ASEAN-China FTA 3.0 concluded May 21—covers 2+ billion people, $234B trade

Pacific Integration: ASEAN-Australia-New Zealand FTA live April 21—cuts 99% tariffs on $120B annually

Bilateral Defiance: South Korea-Vietnam target $150B trade by 2030 despite US tariffs, up from $80B in 2024

Digital Trade Rules: China-ASEAN finished CAFTA 3.0 May 22—adds digital/green tech chapters covering $890B services

Africa Goes Solo: African Continental Free Trade Area launched Pan-African Payment System June 1—instant settlement, 42 currencies

Our Insight 🧐

American Irrelevance: ASEAN-China FTA 3.0 creates the world's largest trading bloc without US participation, highlighting Asian economies’ strategic alignment with China’s growing market amidst evolving global trade dynamics

Supply Chain Rewiring: Australia-New Zealand deal positions resource exporters to feed Asian manufacturing exclusively—critical minerals flowing East while West scrambles for alternatives

Tariff Workarounds: Korea-Vietnam target reveals Asian strategy: bilateral deals circumvent US restrictions—expect proliferation of country-pairs trading in local currencies, bypassing dollar entirely

Digital Sovereignty: CAFTA's digital chapters establish Chinese tech standards across Asia—from payment systems to AI governance, Beijing writes rules while Washington imposes tariffs

African Leapfrog: Pan-African payments eliminate dollar dependency for 1.4 billion people—continent skipping Western financial infrastructure entirely, building Chinese-compatible systems from scratch

What Does This Mean For You? 🎯

Product Availability Shift: As Asia trades internally, expect certain electronics and goods to become "Asia-only" releases—popular phones, and gadgets may launch exclusively in ASEAN markets, bypassing the US entirely

Investment Opportunities: Asian market integration creates winners outside US reach—consider international brokers offering access to ASEAN exchanges before American investors get completely locked out

Currency Exposure: With trade deals bypassing dollars, your USD savings lose global purchasing power—explore holding small positions in Asian currencies or gold as dollar dominance erodes

Career Geography: Tech and manufacturing jobs following trade flows to Asia—if under 40 and in affected industries, consider learning Mandarin or Korean while opportunities still exist

Shopping Strategy: African payment integration means new e-commerce players emerging—early adopters accessing African marketplaces might find unique products and investments before Western companies catch up

Economic Trends

Labor Market Evolution

Quick Facts 📈

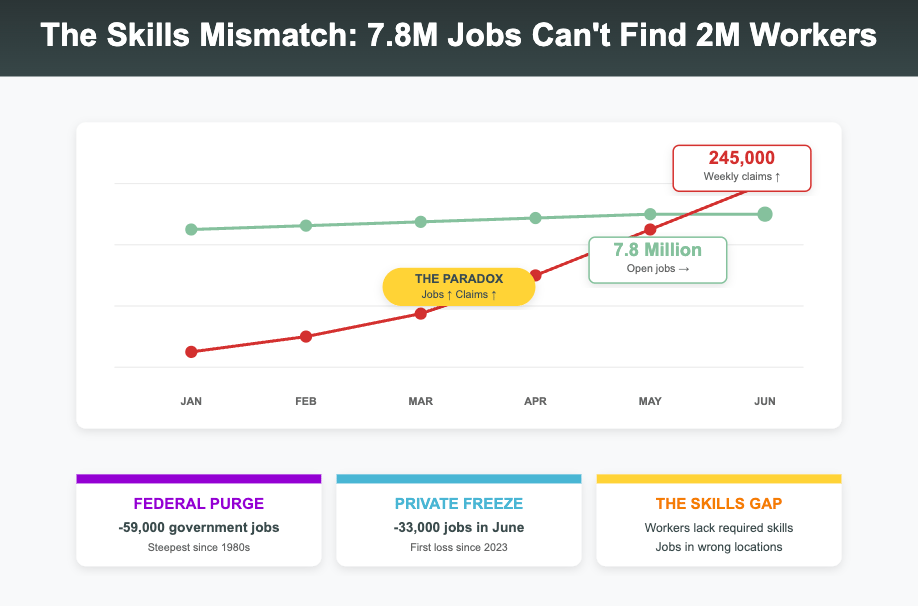

Federal Purge Accelerates: Federal employment down 59,000 since January 2025; 22,000 lost in May—steepest cuts since early 1980s

Private Sector Stalls: Private payrolls added 37,000 May, lost 33,000 June—first monthly drop since March 2023

Massive Downward Revisions: March/April slashed by combined 95,000 positions—growth 35% weaker than reported

Jobless Claims Surge: Weekly claims hit 245,000 mid-June; 4-week average 245,500—highest since August 2023

Skills Mismatch Paradox: 7.8 million jobs unfilled May while continuing claims reached 1.97 million—highest since November 2021

Our Insight 🧐

Government Efficiency Drive: The federal workforce reduction represents the most aggressive downsizing since Reagan's first term, signaling a fundamental shift in the government's role as an employer of last resort

Tariff Uncertainty Freezes Hiring: The recent volatility in trade policy may influence private sector job creation as businesses could hesitate to expand amidst uncertain input costs

Reality Check on Recovery: The 95,000-job revision exposes how initial reports painted an overly rosy picture; the labor market has been deteriorating faster than headlines suggested

Leading Indicator Flashing Yellow: The 4-week claims average breaking above 245,000 historically precedes unemployment rate increases by 2-3 months—we're seeing early warning signs of broader weakness

Two-Speed Labor Market: The coexistence of 7.8 million openings with rising unemployment reveals a broken matching mechanism—available workers lack the skills employers need, while skilled workers aren't where the jobs are

What Does This Mean For You? 🎯

Federal Job Seekers Beware: If you're eyeing government work, consider pivoting now—these cuts aren't temporary political theater but a structural shift that will likely persist through 2025

Private Sector Caution: Don't expect aggressive salary negotiations to work; with hiring frozen and layoffs beginning, employers hold all the cards in compensation discussions

Trust But Verify: Initial jobs reports are increasingly unreliable; consider waiting for revisions before making major career decisions based on "strong" employment headlines

Update That Resume Now: With claims trending toward recession levels, the window for job switching is closing fast—if you're thinking about a move, consider prioritizing that next move sooner rather than later.

Skill Up or Get Left Behind: The jobs-skills mismatch means generic experience won't cut it; consider investing in specific certifications or training in high-demand areas like healthcare, skilled trades, or specialized tech

Consumer Behavior Patterns

Quick Facts 📈

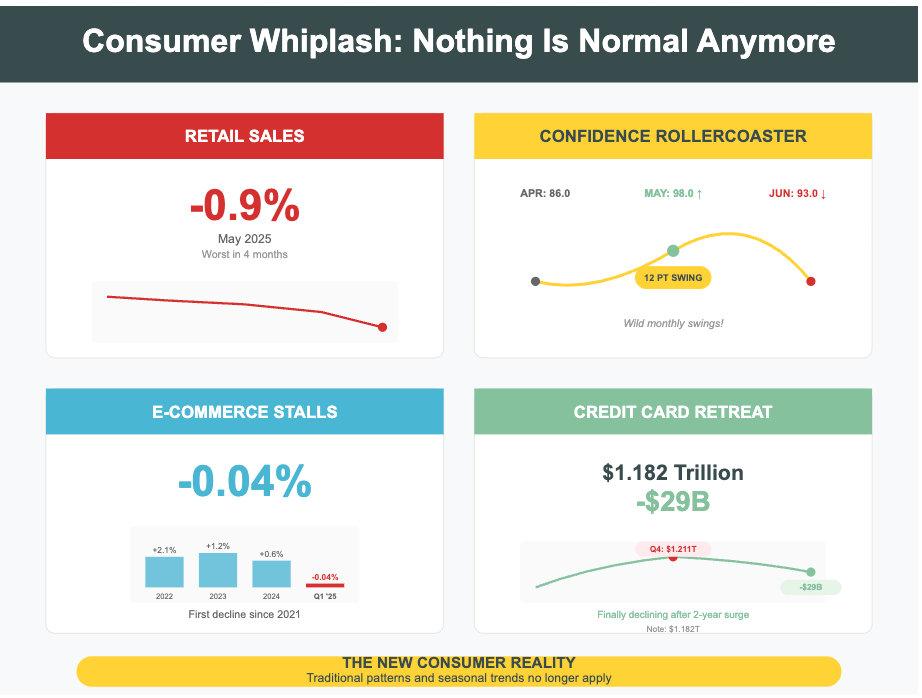

Retail Sales Collapse: Retail tumbled 0.9% May 2025 to $715.4B—largest 4-month drop, worse than 0.7% expected

Confidence Whiplash: Consumer confidence: 86.0 April→98.0 May→93.0 June—well below recession thresholds

E-commerce Stagnation: E-commerce fell 0.04% Q1 2025 to $300.2B—first quarterly contraction since 2021

Credit Growth Moderating: Consumer credit slowed to 4.3% annually April; cards at $1.182T, down from Q4's record $1.211T

Sentiment Recovery: Michigan sentiment surged 16% June to 60.7—still 18% below December's post-election 74.0

Our Insight 🧐

Tariff-Driven Pullback: The 0.9% retail plunge reflects consumers front-loading purchases in March ahead of import duties, then slamming the brakes—motor vehicle sales cratered 3.5% as the 25% auto tariff bite became real

Emotional Rollercoaster: The confidence volatility reveals a consumer psyche whipsawed by policy uncertainty—May's temporary China deal sparked hope, but June's Middle East tensions and persistent tariff fears crushed optimism again

Digital Disruption Pauses: E-commerce's first quarterly decline in four years signals that even online shopping isn't immune to economic anxiety—consumers are hesitating on discretionary purchases regardless of channel

Credit Card Retreat: The $29 billion Q1 decline in credit card balances suggests consumers are finally hitting their borrowing limits after two years of inflation-driven debt accumulation

Perception vs. Reality Gap: Michigan sentiment's 16% jump shows consumers respond dramatically to policy shifts, yet the absolute level (60.7) remains in historically pessimistic territory typically associated with recessions

What Does This Mean For You? 🎯

Shop the Dips Strategically: With retailers desperate to move inventory after May's disaster, expect deep discounts in July-August—time major purchases around these clearance events

Brace for Mood Swings: Consumer confidence will remain volatile through 2025; don't make major financial decisions based on monthly sentiment shifts—focus on your actual income and expenses

Rethink Online Shopping: E-commerce's struggles mean better deals might actually be in physical stores as retailers prioritize clearing brick-and-mortar inventory

Credit Card Caution: With balances finally declining, maintain this discipline—the average 21.91% APR makes carrying balances financially devastating in this environment

Trust Your Gut, Not Headlines: If sentiment at 60.7 feels disconnected from your reality, you're not alone—focus on your personal financial situation rather than aggregate mood indicators

Housing & Real Estate Markets

Quick Facts 📈

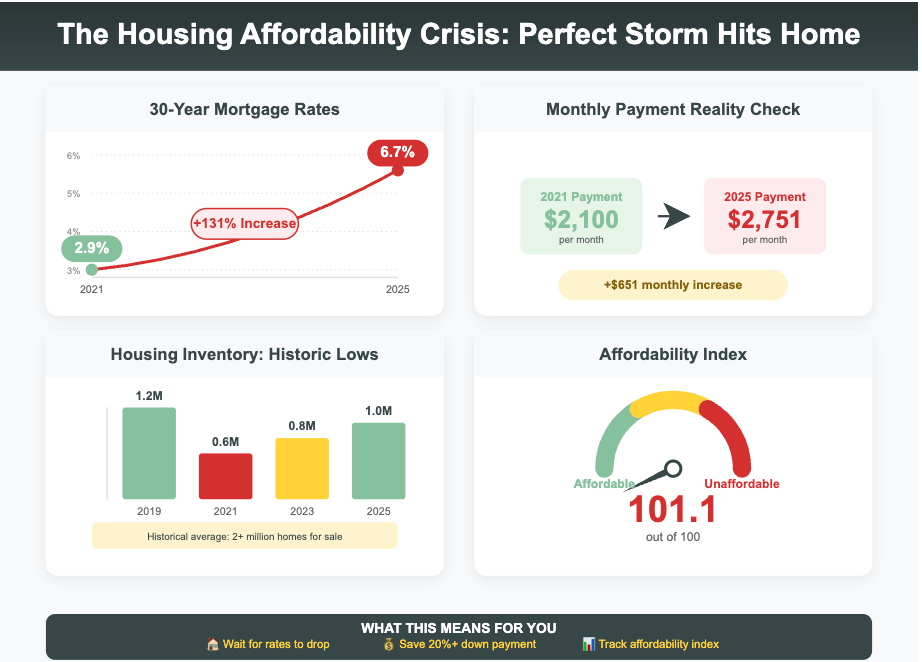

Peak Price Paradox: Home prices hit record—Case-Shiller 20-City reached 341.48 April, but growth crashed to 3.4% annually—market exhaustion

Existing Home Gridlock: May median price soared to record $422,800 while sales crawled 0.7% below last year at 4.03 million annually

New Home Collapse: New sales plummeted 13.7% May to 623,000 annually—steepest drop since 2022—inventory ballooned to 9.8 months

Rate Relief Stalls: Mortgages stuck near 6.8% all Q2, edged to 6.77% June 26—still double pre-pandemic

Inventory Breakthrough: Housing inventory surged 16.2% YoY May; only 31.2% sold above list—lowest May reading in 5 years

Our Insight 🧐

Price Growth Hitting Wall: The dramatic slowdown from double-digit gains to 3.4% annual growth reveals affordability has finally broken the market's momentum—buyers simply can't stretch any further

Frozen by Rates: Existing home sales at 4.03 million represent just 75% of normal pre-pandemic activity; the mortgage rate lock-in effect has created a generational market freeze

Builder Panic Mode: New home sales cratering while inventory approaches 10 months of supply signals builders massively overshot demand—expect deep incentives and price cuts ahead

False Floor at 6.8%: Despite Fed pause hopes, mortgage rates refuse to break meaningfully below 6.8%—the new normal appears cemented well above the sub-4% rates buyers grew accustomed to

Power Shift to Buyers: With inventory up 16% and bidding wars vanishing, the market psychology has flipped—sellers who missed the peak are now chasing a shrinking buyer pool

What Does This Mean For You? 🎯

Wait for the Crack: With price growth decelerating rapidly, patience pays—waiting 6-12 months could save you tens of thousands as seller desperation intensifies

Negotiate Aggressively: Only 31% of homes selling above list means lowball offers are back in play; start 5-10% below asking and demand seller concessions

Target New Construction: Builders sitting on 10 months of inventory will offer massive incentives—look for rate buydowns, free upgrades, and closing cost coverage

Lock When You See 6.5%: If rates briefly dip toward 6.5%, lock immediately—the 6.8% plateau suggests meaningful relief isn't coming anytime soon

List Now or Hold Forever: If selling, move fast before inventory surge accelerates; if you can't stomach a price cut, prepare to become an accidental landlord for years

US Business Performance & Investment Trends

Quick Facts 📈

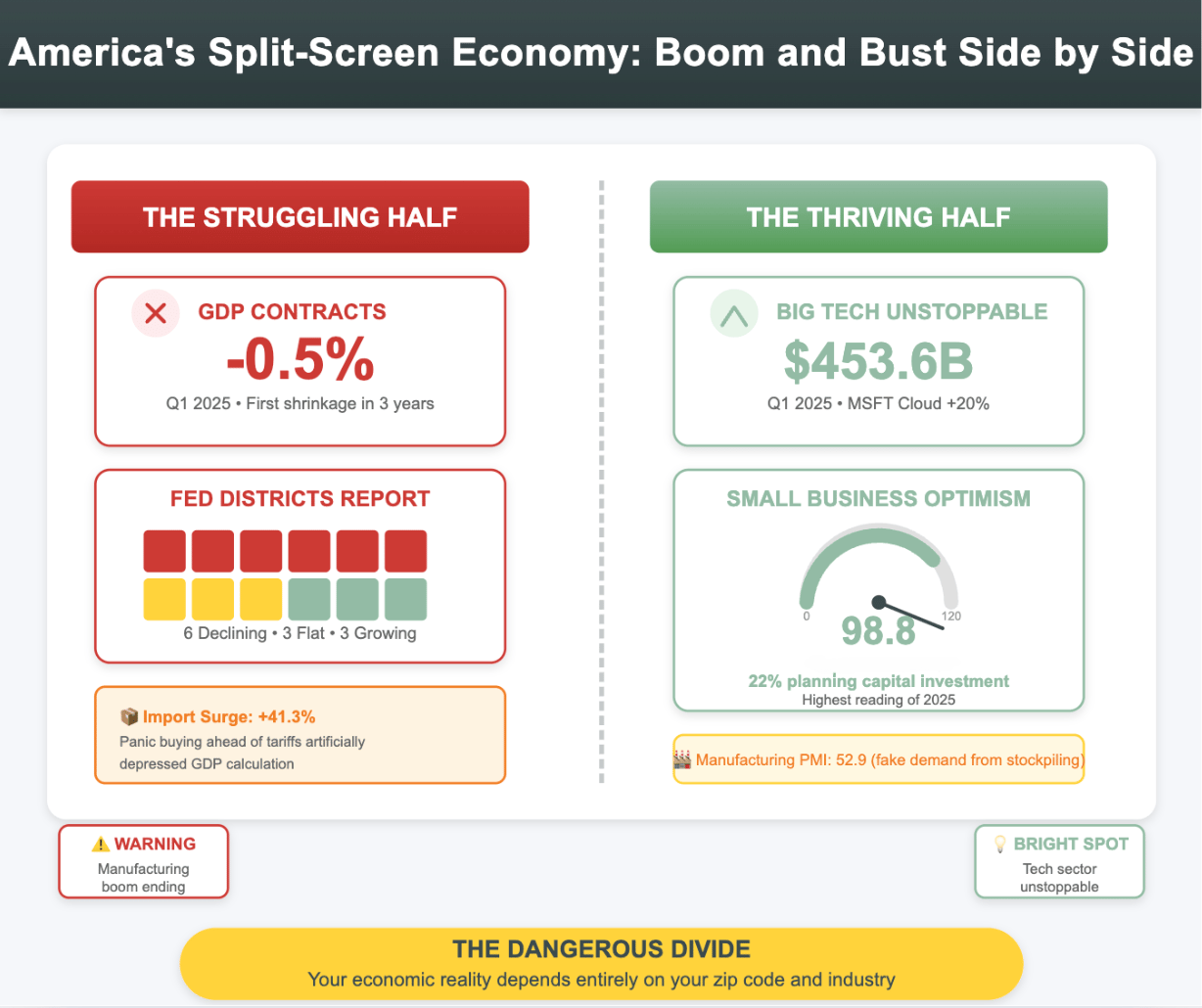

GDP Shock: Q1 2025 GDP contracted 0.5% annually—first shrinkage in 3 years, driven by 41.3% import surge as businesses front-loaded ahead of tariffs

Main Street Optimism: Small business optimism rebounded to 98.8 May from 95.8 April; 22% planning capital investments—highest 2025 reading

Fed's Grim Report: Six of twelve Fed districts reported declining conditions June Beige Book—manufacturing and loan demand particularly weak

Tech Giants Unstoppable: Big Tech posted $453.61B combined Q1 revenue; Microsoft cloud surged 20% to $24.1B despite economic weakness

Manufacturing Surge: S&P Global Manufacturing PMI jumped to 52.9 June—highest in 3 years—driven by tariff stockpiling not real demand

Our Insight 🧐

Artificial Contraction: The GDP decline may be considered a technical anomaly. Preliminary reports suggest that imports increased 41% as companies adjusted their purchasing ahead of tariffs. This could be mathematically subtracted from GDP figures that might obscure actual economic activity

Small Biz Whiplash: The 3-point optimism jump reveals how sensitive Main Street is to policy clarity—even temporary trade truces spark immediate confidence rebounds

Tale of Two Economies: The Fed's split report card (6 districts down, 3 flat, 3 up) signals a dangerously uneven recovery where coastal prosperity masks heartland struggles

Cloud Monopoly Accelerates: Big Tech's relentless growth amid economic contraction proves AI and cloud spending have become non-negotiable business infrastructure, not discretionary tech investments

False Manufacturing Renaissance: The recent PMI surge to 52.9 may be influenced by companies adjusting inventories in response to tariffs rather than expanding production capacity for sustained growth

What Does This Mean For You? 🎯

Don't Panic on GDP Yet: The Q1 contraction appears as more import-driven noise, not a recession yet—if you're employed and spending normally, trust your experience over the headline number for now

Support Local Business Now: With 22% of small businesses planning investments, your local economy needs customer support to justify their optimism—shop small to create a self-fulfilling prophecy

Geography Matters More: With half of Fed districts struggling, your economic reality depends heavily on zip code—consider relocating from declining regions to growth areas

Ride the Tech Wave: Big Tech's unstoppable growth means their ecosystem offers the most recession-proof opportunities—prioritize skills and careers adjacent to cloud/AI platforms

Beware Inventory Illusion: Manufacturing's "boom" is temporary stockpiling; if you work in manufacturing, prepare for a sharp pullback once tariff-driven hoarding ends in late 2025

Price & Inflation Trends

Quick Facts 📈

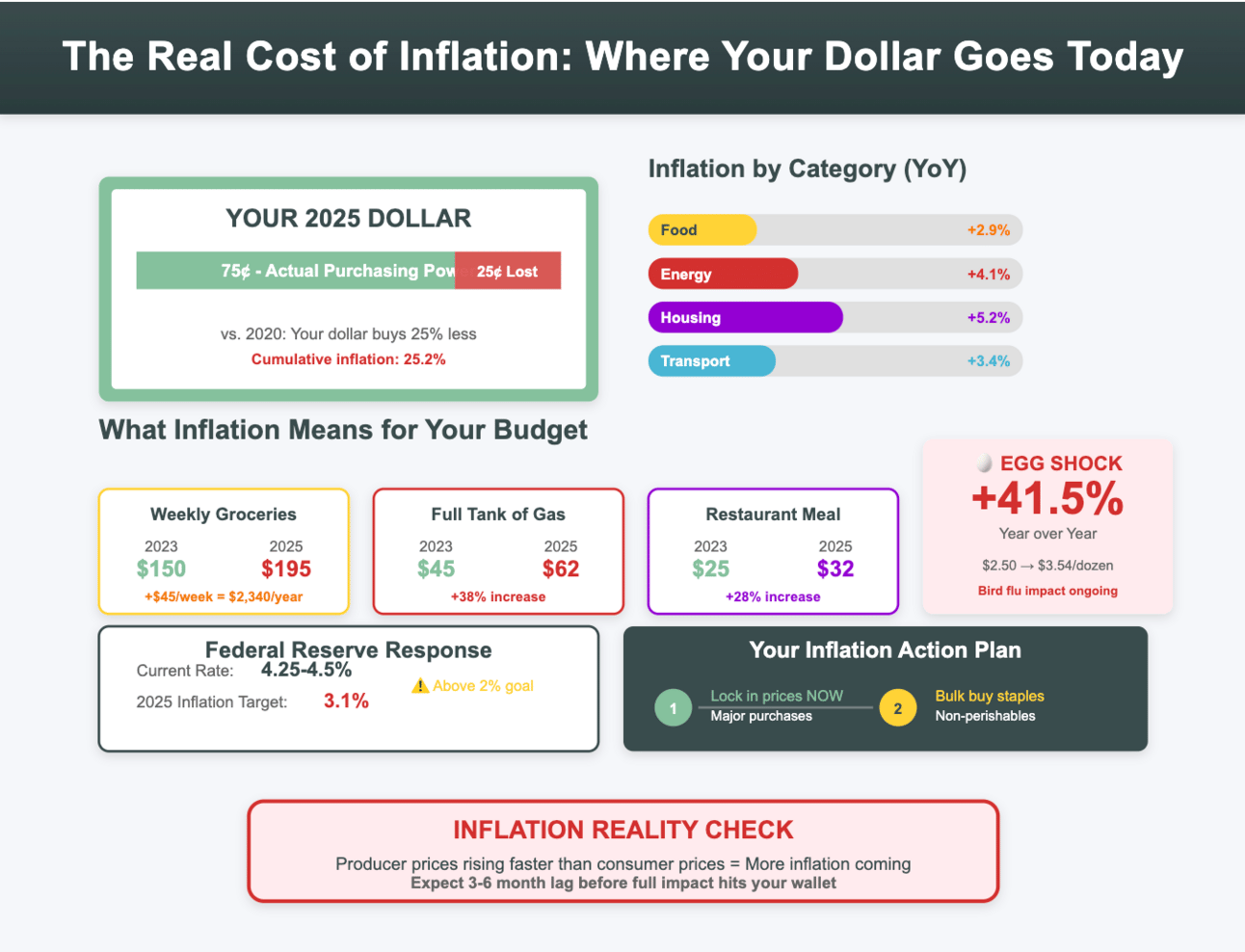

CPI Cooling: April CPI cooled to 2.3% annually—smallest since February 2021; core CPI 2.8% as tariff impacts stayed muted

Producer Price Rebound: Producer prices rebounded May to 2.6% yearly after April's 2.4%—signals pipeline inflation ahead

PCE Acceleration: PCE inflation accelerated to 2.3% May with core 2.7%—stubbornly above Fed's 2% target despite 3 years tightening

Fed Inflation Forecast: Fed held 4.25%-4.5% rates while raising 2025 core inflation forecast to 3.1% from 2.8%—tariff concerns + sticky services

Persistent Food Inflation: Food rose 2.9% YoY; eggs still 41.5% higher than last May despite monthly declines—ongoing avian flu

Our Insight 🧐

Tariff Lag Effect: April's benign CPI suggests the widely anticipated tariff-driven inflation spike hasn't materialized yet—businesses absorbed costs or drew down pre-tariff inventories, but this cushion won't last forever

Supply Chain Warning: The divergence between PPI rebounding and CPI cooling indicates producers are starting to feel cost pressures they haven't yet passed to consumers—expect this gap to close in H2 2025

Services Stickiness: Core PCE's persistence at 2.7% reveals the real inflation battle isn't in goods (where tariffs hit) but in services like housing and healthcare, where wage pressures keep prices elevated

Fed's Tariff Dilemma: The upward revision in inflation forecasts despite holding rates steady shows the Fed is caught between fighting potential tariff inflation and avoiding recession—they're choosing to wait and react rather than preempt

Food's Perfect Storm: The 41.5% egg price surge exemplifies how supply shocks (bird flu) compound with broad inflation—when 127 million egg layers have been culled since 2022, even cooling demand can't offset the supply destruction

What Does This Mean For You? 🎯

Lock in Prices Now: With producer costs rising faster than consumer prices, the window for major purchases at current prices is closing—consider accelerating big-ticket items before businesses pass costs through

Bond Opportunity Window: The Fed's pause at 4.25%-4.5% while inflation expectations rise creates a sweet spot for locking in yields before potential rate cuts later in 2025—don't wait for the "perfect" moment

Service Budget Squeeze: Plan for continued pressure on your services spending (rent, healthcare, dining out) as these costs show no signs of moderating even as goods prices stabilize

Inflation Hedge Reality Check: The Fed's 3.1% inflation forecast for 2025 means your cash is losing purchasing power faster than the historical 2% target—ensure your portfolio includes assets that can outpace this erosion

Strategic Grocery Shopping: With food inflation outpacing general inflation, bulk buying non-perishables and exploring alternative proteins becomes a financial strategy, not just a lifestyle choice—those egg prices aren't coming down soon

Disclaimer: This newsletter is for informational purposes only. It is not financial advice or an endorsement of specific investments. Always consult with a financial advisor to ensure your investment decisions align with your goals and risk tolerance.

Reply